CBRS Auction 105: Cable Company Results

After the close of the CBRS auction a lot of attention has been given to Verizon and Dish and the subsequent impact on the pending C-Band auction (Link to Prior Coverage on MNO Auction Results). However, the threat of cable companies is often dismissed even though Cox, Comcast, and Charter rounded out the list of top 5 bidders.

While CBRS is frequently bench-marked against valuable mid-band spectrum like T-Mobile’s 2.5GHz and C-Band’s 3.7-4.2 GHz it is discounted for its lower power restrictions. Compared to WiFi, CBRS offers enhanced coverage and capacity. Cable MVNOs with a dense small cell network are uniquely positioned to capitalize on CBRS’s low power. Small cell network architecture takes advantage of non-uniform traffic distribution to strategically place cell sites where they matter most while relying on a host network to provide a more costly coverage layer.

Today, cable MVNOs rely on dual-SIM or eSIM technology to provide a WiFi first network experience whenever possible; falling back onto an MNO’s network as part of their MVNO agreement. With newly acquired CBRS spectrum and wide device support from popular flagship handsets including Samsung’s Galaxy S10, Apple’s iPhone 10, and Google’s Pixel we could begin to witness a shift in cable MVNO offload strategy and subsequent network economics.

As evidence of cable companies readiness to leverage CBRS look no further than Craig Cowden, Charter’s Chief Network Officer, who has shared publicly Charter’s extensive trials for rural fixed wireless access and a small-cell-first MVNO strategy starting as early as 2017. A brief summary of Charter’s CBRS trials below:

Rural Fixed Wireless

Private LTE fixed-wireless networks in rural North Carolina to extend the reach of the operator’s HFC network.

Fixed wireless services in Denver via equipment installed on rooftops

Van mounted fixed wireless testing in Bakersfield, Tampa and Michigan to expand its service area

Small Cell First MVNO

Mobile access in New York and Los Angeles

Outdoor small cells in Downtown Tampa and Charlotte trialing mobile hand-off

At the close of auction 105 the FCC had raised ~$4.6B at an average price of $.22/MHz/Pop. The smaller license area offering lower entry prices, the availability of dynamic spectrum sharing, and the allure of new or improved business cases with private LTE and fixed wireless attracted 257 bidders with 228 licensees walking away with licenses. Cable MVNOs accounted for as much as $1.1B or 25% of total license fees gobbling up more than 1,600 licenses.

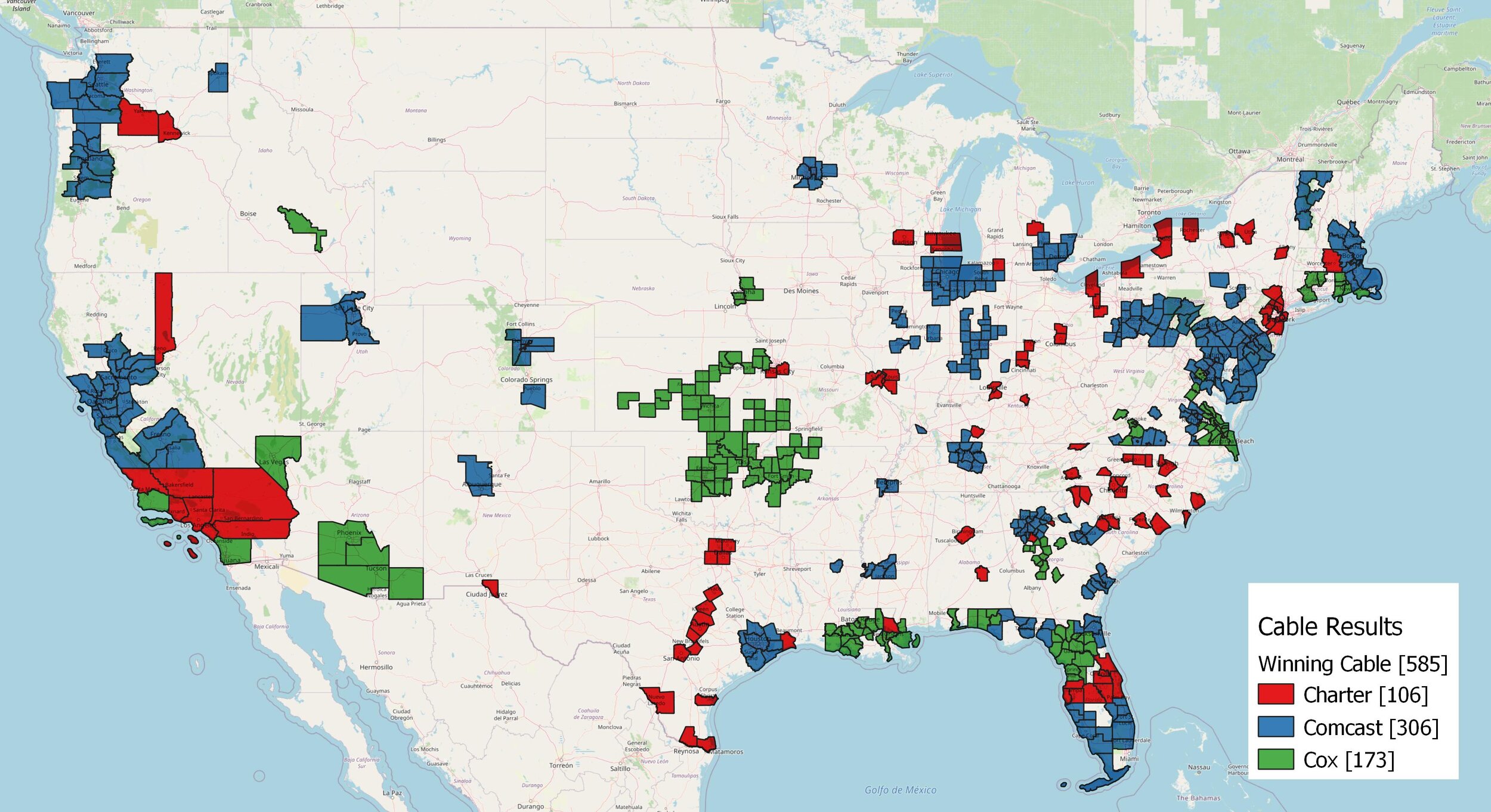

The map above shows the $/MHz/Pop for each county. An interactive 3D version is available here.

The map above shows the cable footprint for Charter, Comcast, and Cox. Source: FCC

Cable companies have a strong presence in all major population centers, however, they tend to have very little overlap which enables them to collaborate closely.

Throughout the course of the auction competition between the cable companies was fairly limited with 113 (almost 20%) of the markets attracting more than 1 cable bidder.

However, by the close of the auction all but 18 (3%) markets had been awarded to a single cable company.

County licenses awarded by cable company.

Comcast (Xfinity Mobile)

Comcast, the nation’s largest cable operator, has a broadband footprint spanning 39 states and a subscriber base of ~27M households. Since the launch of Xfinity, Comcast has amassed 2.4M wireless subscribers capturing customers from incumbents like AT&T, Verizon, and T-Mobile.

Comcast entered the CBRS auction with 10MHz in the 600MHz band covering key markets including NY, SF, and Chicago. At the end of the auction Comcast had spent $459M to acquire 830 licenses across 306 counties covering 100M people with an average of 3.1 licenses per county. Comcast paid an average $.19/MHz/Pop, slightly below the auction average.

Charter (Spectrum)

Charter with a cable footprint covering 52M homes and businesses has ~25M high speed broadband subscribers and established a wireless customer base of ~1.4M subscribers.

During the auction Charter acquired 210 licenses across 106 counties at a price of $474M. Their CBRS spectrum licenses cover 74M people with an average depth of 2.0 licenses per county at a price of $.34/MHz/Pop.

Cox

Cox has yet to stake its flag in the MVNO space and is the smallest of the cable providers with an estimated 3.5M broadband customers. However, Cox was an active bidder in the auction paying $212M for 470 licenses in 173 counties at an average of $.27/Mhz/Pop. Their CBRS licenses cover ~33M people or 10% of the population.

$/POP/MHz vs. POP density for every county. Size of circle represents carriers acquired. For an interactive chart click here:

County licenses awarded by cable company overlapped with existing cable service areas.

With all 3 cable companies winning predominantly non-overlapping CBRS licenses it is likely they will pursue a network sharing and/or roaming deal in an effort to improve their network economics in direct competition with MNOs.

The opinions expressed in this case study are based on publicly available information and do not claim to represent any companies views or strategy.